ΣΧΕΤΙΚΑ ΑΡΘΡΑ

They say opportunity dances only with those who dare to step onto the stage…

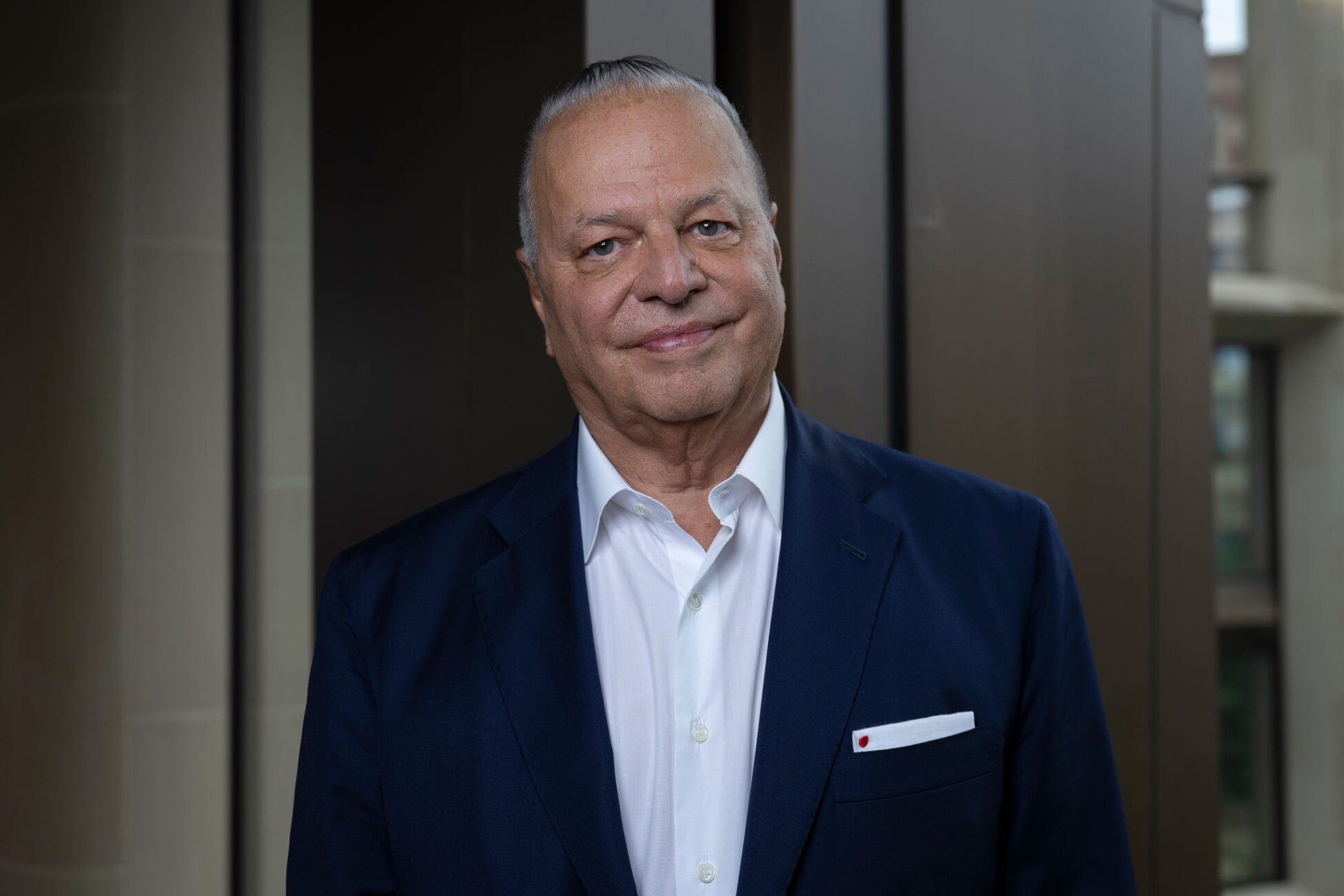

The far-from-random businessman Evangelos Mytilineos proves through his remarkable journey that he hasn’t merely stepped onto the business stage. He has managed to be at the forefront of multifaceted developments, taking centre stage.

With recognised skill, a strategic focus and a vision to identify opportunities, he leads this dance of resounding successes, seeming as if he choreographs it himself.

Indeed, over a period of nearly five decades, he is the one who has personally stamped his mark on the holistic transformation of a small, family-run metallurgical company into today’s colossus that is Metlen Energy & Metals. A robust industrial and energy multinational company, poised to expand internationally via a public listing as well.

After 30 years of presence in the Athenian ‘temple’ of money and the stellar returns delivered to shareholders, Evangelos Mytilineos’ Metlen is now attempting to upgrade its investor visibility with a listing on the London Stock Exchange (LSE). Europe’s premier market attracts interest from the global elite of fund managers and its listed businesses bear a value which exceeds €4 trillion. This means it is 31 times larger than the Greek market, where Metlen aims to maintain a parallel secondary listing.

To complete the LSE listing procedure, the over 30,000 existing shareholders need to mobilise and respond by Friday, 25 July to a simple process of accepting a share exchange offer (at a 1-to-1 exchange ratio), so that the new, successor business entity can secure at least 90% of the shares.

The new page and the «miracle» of market valuation

If this is achieved, a new page will begin in Metlen’s exciting story, which is de facto one of the most prominent in the capital market.

Evangelos Mytilineos’ firm made its trading debut on 31 July 1995, in the then ‘alternative’ Parallel Market, upgrading to the Main Market two years later.

The initial offer price of the new share was 1,000 drachmas (equivalent to €3.52). It raised €1.2 million, with demand exceeding supply by 65.2 times.

The company was admitted to the ‘temple’ of money valued at €8.27 million. Thirty years later, Metlen, as a robust business of international eminence, now has a market cap (as of Thursday, 17 July) of €6.61 billion – a 799-fold increase.

A unique case in the Greek market

This is a unique phenomenon in the Greek market, since out of the roughly 45 companies continuously listed on the Athens Stock Exchange since 1995, none has performed a leap like this.

The acquisitions of METKA and Aluminium of Greece had a pivotal role. Following the merger of these subsidiaries under Metlen, the new shares issued as part of the exchange processes are now valued at around €1.6 billion.

The rapid surge in the creation of shareholder wealth comes as a direct result of Metlen’s relentless and ever-renewing entrepreneurial momentum. A company that combines the enviable growth margins of a start-up with the reliability and large scale of a heavyweight industry entity that always looks ahead.

With its charismatic executive leader and main shareholder, Evangelos Mytilineos, emerging, among other things, as a grandmaster of value creation.

How €1,000 have now become €172,888

When at the end of July 1995 Metlen (then ‘Mytilineos’) was entering the Athens Stock Exchange, the minimum salary was 112,225 drachmas, equivalent to just under €300.

So, if an investor had invested the equivalent of €1,000, they would have received 284 shares. By remaining loyal to the company and with the addition of free allocations, they would now hold 3,220 shares – without needing to invest fresh capital and with no participation in capital increases, the last of which happened 26 years ago…

Today, this enriched investment portfolio is worth €148,764, at a current share price of €46.20. Added to that are net dividends and capital returns of €24,124 over these years.

That means that the €1,000 of the initial stake are now €172,888. This is a cumulative return of… 17,189%. It is by far the largest among the companies with a 30-year long listing and it outpaces the inflation in Greece (~109%) over the same period.

Metlen made them millionaires

It is however an especially important fact that if a bigger investor had initially invested €10,000 instead, they would now have become a… millionaire due to their shareholding position in Metlen. They would now hold approximately €1.72 million from share appreciation and dividends; literally windfall gains for those who stayed loyal to Evangelos Mytilineos’ business visions.

Just as a point of reference, over these last 30 years, the price of gold has increased by 8.7 times, the emblematic Dow Jones index has risen 9.4-fold, while Nasdaq has surged by 23 times. As for the Athens General Index, it has increases by 2.1 times, (having had however significant changes in its composition).

These benchmarks pale beside Metlen’s performance and the company’s ‘golden’ shareholder returns.

Bottom of Form

Returns over the past 10 and 5 years

Here are the data on returns over other specific time periods:

Over the last 10 years: The starting point for this investment could have been the 3rd of August 2015, when the Athens Stock Exchange reopened after being closed for about a month during some turbulent days for the country.

At the… restart of the Stock Exchange, the purchase of 200 shares of Metlen at €4.97 each, as listed on the board, would have a cost of €994.

Today, those shares are worth €9,240, and they have also generated net dividends of €1,230. Therefore, the total value of the investment is €10,470, which translates to a return of 953%, equivalent to approximately 85% annually…

Over the last 5 years: In this case, buying 150 shares on 31 July 2020 would have cost €1,176, given that the share price at the time was €7.84.

Today, those shares are worth €6,930, and along with the net dividends collected (€768), the total valuation rises to €7,698. This equates to a return of 555%. It is as if someone had invested their capital at a steady and clear annual interest rate of 111%…

With these impressive credentials, Metlen is now on its way to the London market, where its shares will continue to be traded in euros.

What Mytilineos says about the benefits for shareholders

As Evangelos Mytilineos points out: “shareholders who choose to accept the offer:

First, retain their stake in the now UK-based Metlen PLC, which is positioned within a broader international environment. Second, the UK company will have access to enhanced trading and capital-raising opportunities. And third, they continue to be shareholders in a truly international company, with strong performance, global expansion, and a deep, enduring relationship with Greece.”

Adding that: “Although our listing on the London Stock Exchange is an international step, our identity remains Greek. Metlen will continue to be a proud employer and investor in Greece, with no impact on daily operations, employees, or management.”

With its entry into the London market, Metlen is also expected to join the FTSE 100 index. Based on current market capitalisations, it ranks 70th and 50th in terms of profitability.

According to the latest 7 reports from international firms and Greek brokerage houses, the average price target for the stock is €60, suggesting 30% upside potential.

As once said by Marlon Brando, one of Evangelos Mytilineos’ favourite actors: “He who follows his own path is not likely to be overtaken…”

ΕΙΔΗΣΕΙΣ ΣΗΜΕΡΑ

- Δήμος Αθηναίων: Έκτακτα μέτρα για την προστασία των ευάλωτων πολιτών από τις χαμηλές θερμοκρασίες που αναμένονται

- Θεοδωρικάκος: Όταν η πολιτική ενώνει και επιλέγει την αλήθεια και την ευθύνη, τότε μπορεί να αλλάξει η πορεία της χώρας

- Βρετανία: Ανακοίνωσε ότι αναπτύσει βαλλιστικό πύραυλο για την Ουκρανία

- Κούβα: Η απάντηση στις απειλές Τραμπ – «Κανείς δεν μας υπαγορεύει τις θα κάνουμε»